Eligible Types of Housing

How To Apply

Make sure the Applicant/Developer/Borrower meets all LIHTC requirements.

Ensure all resident or potential low-income resident qualifications are met.

Download and complete DSHA’s LIHTC application package including all relevant exhibits and submit to DSHA by the applicable program year deadline.

Applicant Qualifications

Nonprofit and for-profit developers may apply for the LIHTC program.

This program allows both corporate and private investors to receive a fair return on their investment in affordable housing. The program design allows individuals, as well as limited partnerships who own rental housing for low-income families, to utilize the credit.

Resident Qualifications

At minimum, all LIHTC projects must meet IRS and DSHA household/resident restrictions:

Households whose incomes do not exceed 60% of the median income based on family size and county location are eligible to reside in tax credit properties. Rents are capped to remain affordable to families earning less than 60% of median income.

The owner of a qualified low-income building must rent at a minimum either 20 percent of the units to households with incomes of 50 percent or less of the area median income or 40 percent of the units to households with incomes of 60 percent or less of the area median income.

A certain percentage of all units must be set aside to serve the needs of some of Delaware’s most vulnerable populations.

Tax Credit Policies, Forms, and Compliance Documentation

Please download and review the documents below to learn more about tax credit policies, get forms, and understand compliance issues.

Area of Opportunity Land Bank Program

DSHA set-aside $5,000,000 (subject to availability) in funding for the Area of Opportunity Land Bank program. The Area of Opportunity Land Bank Loan (“AO Land Bank”) program aims to help facilitate the creation of affordable rental housing in high-opportunity areas. Applications will be accepted on a rolling basis as long as funds are available.

LIHTC Funding Round Documentation

2025 – 2026

- DSHA Real Estate Development Schedule

- DSHA Litigation Disclosure

- DSHA Net Liquid Assets Disclosure

- Management Agent Qualification Application

- Management Agent Requirements

- Management Agent Approval Submission Requirements

- Management and Marketing Plan Checklist

- 811 and Target Unit Performance Certification

- Social Services Certification

- Affirmative Fair Housing Marketing Plan

- State of Delaware Reality Transfer Tax Declaration

- Environmental Review Checklist

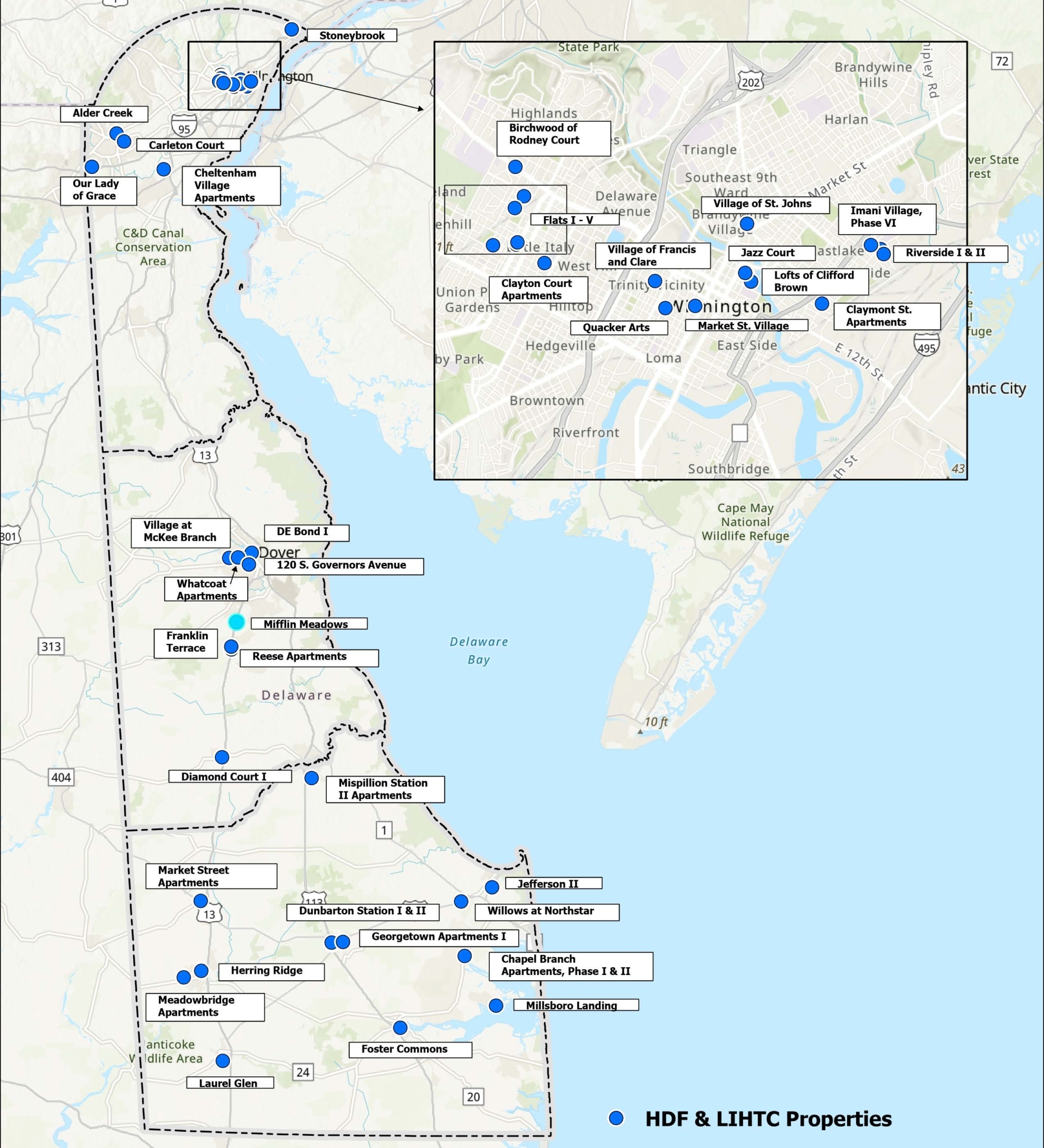

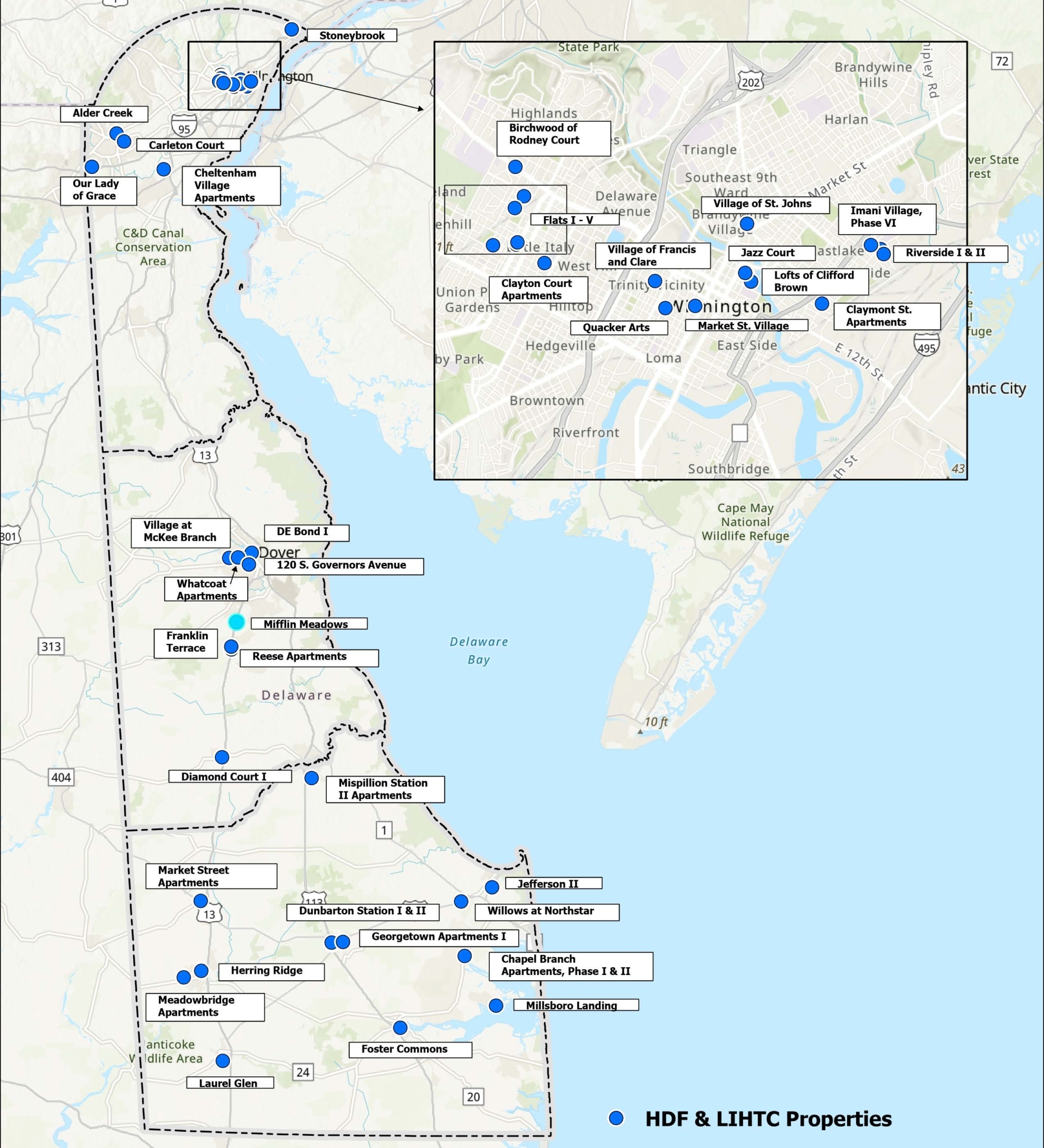

- 2025-2026 QAP Map – Reference Guide

- DDA, QCT, OZ (2025)

- DDD Certification

- OZ Certification

- Certification for Concerted Community Revitalization Plan

- Access to Transit

- Market Study Requirements

- Pre-approved List of Market Study Providers

- Fair Housing Design Standards Certification

- DSHA Base Level Energy Standards

- Energy Conservation Measures

- DSHA Base Level Green Standards

- Utility Benchmarking Certification

- Integrated Housing for Special Populations Certification PSH UNITS

- Integrated Housing for Special Populations Certification TARGET UNITS

- Integrated Special Needs Targeting Plan

- Social Services MOU

- DSHA Resilience Assessment Tool

- CNA Rehabilitation Standards Checklist

- CNA Environmental Due Diligence

- DSHA Relocation Draw Template

2023 – 2024

- DSHA Real Estate Development Schedule

- DSHA Litigation Disclosure

- DNet Liquid Assets Disclosure (new)

- Management Agent Qualifications Application

- Management Agent Requirements

- Management Agent Approval Submission Requirements

- Management Agent Marketing Plan Checklist

- Management Agent Performance Certification

- Management Agent Social Service Certification (new)

- Affirmative Fair Housing Marketing Plan – AFHMP 935-2A

- Realty Transfer Tax

- Environmental Review Checklist

- QAP 2023 Map Reference Guide

- DDD Certification

- OZ Certification

- Certification for Concerted Community Revitalization Plan

- Delaware Qualified Census Tracts, and Difficult Development Areas

- Access to Transit Certification

- Market Study Requirements

- Pre-Approved List of Market Study Providers

- Fair Housing Certification

- Energy Conservation Measures Certification

- DSHA Base Level Energy Standards

- DSHA Base Level Green Standards

- Utility Benchmarking Certification

- Integrated Housing for Special Populations Certification

- Integrated Housing for Special Populations Targeting Plan

- Integrated Housing for Permanent Supportive Housing Certification

- Social Services MOU

- Resiliency Assessment Checklist

- Architects Readiness Certification

- CNA Requirements

- CNA Rehabilitation Standards Checklist

- CNA Environmental Due Diligence Checklist

- DSHA Relocation Draw Template

- VAWA Forms

- Following items can be found through this link

- Comment Period – Virtual Public Hearing December 12, 2022 10:00 a.m.

- Comment Response, Summary, and Public Hearing Minutes

- Public Comment Form

2021 – 2022

- 2021-2022 QAP

- 2021-2022 QAP Guidelines

- 2021-2022 QAP Download Documents (available upon request)

- 2021-2022 QAP Map

- 2021-2022 LIHTC Application (Part I)

- 2021 LIHTC Points Worksheet (Part III)

- 2021 LIHTC Pro- form (Part II)

- Following items can be found through this link

- Comment Response, Summary, and Public Hearing Minutes

- Comment Period – Virtual Public Hearing December 16, 2020 2:00 p.m.

- Public Comment Form

2020

- 2020 QAP

- 2020 QAP Guidelines

- 2020 QAP Download Documents (available upon request)

- 2020 QAP Map

- 2020 LIHTC Application (Part I)

- 2020 LIHTC Points Worksheet (Part III)

- 2020 LIHTC Pro- form (Part II)

- 2020 LIHTC Exhibit Checklist

2019

- 2019 QAP

- 2019 QAP Guidelines

- 2019 QAP Download Documents (available upon request)

- 2019 QAP Map

- 2019 LIHTC Application (Part I)

- 2019 LIHTC Points Worksheet (Part III)

- 2019 LIHTC Pro- form (Part II)

- 2019 LIHTC Exhibit Checklist

2018

- 2018 QAP

- 2018 QAP Guidelines

- 2018 QAP Download Documents (available upon request)

- 2018 QAP Map

- 2018 LIHTC Application (Part I)

- 2018 Draft LIHTC Points Worksheet (Part III)

- 2018 LIHTC Pro- form (Part II)

- 2018 LIHTC Exhibit Checklist